| 送交者: Qiqi09171[♀★12★♀] 于 2021-01-23 22:44 已读 821 次 | Qiqi09171的个人频道 |

As retail is dying, this could be skyrocketing! With big name retailers like David Jones and Target closing stores in the wake of the COVID-19 pandemic, what experts are calling the “Retail Apocalypse” has been accelerating.

As a result of this retail apocalypse, 167 Target stores are due to close. Even the once mighty David Jones announced it would be cutting 20% of its floor space, which includes closing stores.

In the United States, where we often see economic trends hit long before we see them in Australia — the story is much more advanced.

Former retail titans Sears and Kmart announced 27 closings across July and August this year alone, bringing their total number of stores to just 95. What was once one of the largest retail chains in America is now a sad shell of its former self.

In fact, in a cruel twist of fate, their parking lots and retail space are now used to fulfill Amazon deliveries!

But if you think the worldwide dominance of Amazon is behind this “Retail Apocalypse” … think again.

Because one under-the-radar ASX company could be poised to profit from this death of retail here in Australia, and it’s obviously not Amazon! Sure, while some investors flock to the US based ecommerce giant, Motley Fool Australia thinks there is a lesser-known opportunity right here on our doorstep. And it could soon be nipping at the heels of companies like Amazon.

And better still, many investors haven’t even heard of it yet!

So, just how big is this opportunity?

Now compared to the US, ecommerce has always been slower to catch on here in Australia, but all that has now changed with the global pandemic accelerating online sales.

Analysts now predict a doubling of online retail sales in the next five to ten years, cementing the sector as a potential $50 billion industry.

And this trend could be moving even faster, with one ASX listed company saying it has seen 10 years of online retail growth in just 3 months.

They also see the structural shifts brought on by COVID-19 as permanent and accelerating.

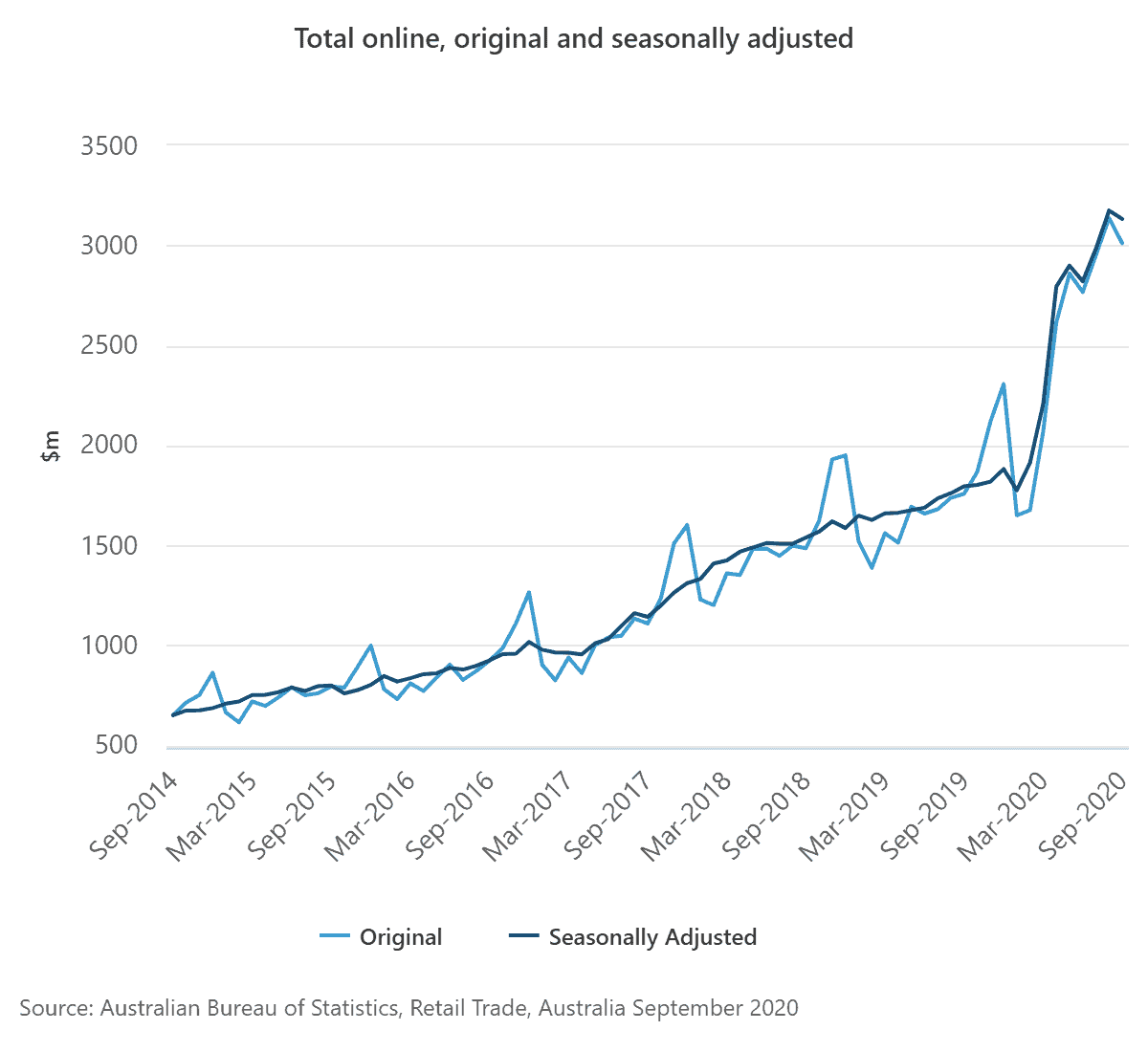

And to be honest with you… I was astounded when I saw this chart I’m about to share with you.

From 2014 to 2019, online retail sales grew from a modest $633 million to $1.77 billion (seasonally adjusted). An impressive but steady increase in online sales of 35% per year.

But look again. That same chart shows, in just one year, that number grew from $1.7 billion to staggering $3.2 billion. Or sales growth of 81% in just a single year!

Put it this way: Thanks to the retail apocalypse, in just one year, online sales have almost doubled!

And Amazon Australia only makes up a fraction of those sales!

Now here at The Motley Fool, we’ve not only found one under-the-radar company we think could be “the next Amazon”… but we’ve found four other serious players in an ecommerce revolution.

And when The Motley Fool finds an ecommerce opportunity, it could pay to listen…

Like in 2017, when our analysts recommended Afterpay to the Motley Fool community at $4.32 a share.

And while Afterpay is a great company that has benefited from the retail apocalypse and changes in consumer behaviour, we can’t help but think there are other opportunities that investors might not even think of!

But how do you separate the greats from the fakes? For every Afterpay, there’s an Openpay. For every JB Hi Fi, a Dick Smith.

Well, at The Motley Fool Australia, our goal is to make investors smarter, happier, and richer.

Which is why Scott Phillips, Motley Fool Australia’s Chief Investment Officer, wants to show you the hard numbers behind this incredible opportunity. And invite you to hear more about how the retail apocalypse will potentially change the Australian shopping landscape forever – that way, you can decide for yourself if you want to buy shares of this fast growing company for your portfolio.

His new report is simply called Beyond Amazon, and not only details the one stock we think could be the next Amazon… but as a bonus, we’re including an additional three stock picks that we think will capitalise on this “Retail Apocalypse.”

There’s just one catch:

We’re sharing the details of these companies only with members of The Motley Fool Australia’s flagship investing service, Motley Fool Share Advisor.

Now why should you listen to the experts at Share Advisor? Well Motley Fool Share Advisor has been helping investors find great stocks since 2011!

Just take a look at some of the big winners Share Advisor members have seen!

Corporate Travel Management on 23 August 2012: +917%Cochlear Limited on 26 April 2013: +303%Premier Investments on 27 June 2013: +322%ResMed Inc on 24 May 2013: +543%Certainly not every stock will do as well as these, but the bottom line is this: the full list of winners is much longer, with the average Share Advisor pick beating the All Ords by more than 26%!

That’s why I think it’s important to capitalise on this opportunity by securing your copy of Beyond Amazonright now, before the offer goes away.

It reveals the reasons why we think every forward thinking investor should be paying close attention to this seismic shift in retail and what might be a potentially life-changing investment opportunity.