| 送交者: 我爱胡静[♂★★体坛小东邪★★♂] 于 2020-11-16 18:08 已读 828 次 2 赞 | 我爱胡静的个人频道 |

回答: 想请教下为什么银行是value trap 谢谢! 由 phoo 于 2020-11-16 17:52

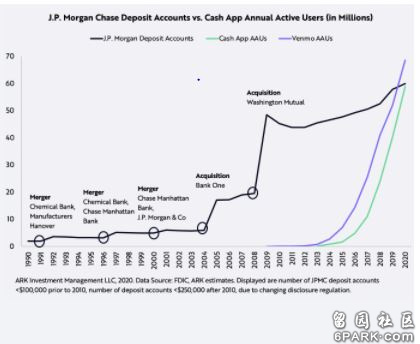

6park.com(紫色的线是Paypal的Venmo,绿色的线是Square的Cash App) 6park.comWe believe that Square’s (SQ) Cash App could become a leading global consumer financial services provider. If Cash App can monetize 20% of its US user base at the level of traditional banks today, then with modest growth in its seller business, SQ could return 19% at an annual rate during the next five years, rising from $150 today to $375 per share in 2025. 6park.comTo foster healthy debate, on Github we have published an extract of our Square valuation model with explanations at the link here. Intentionally, we have not incorporated the potential for Square’s international business, an important call option. Feel free to change variables to battle test our assumptions and share your thoughts with us. We will welcome all questions, feedback, and constructive criticism. 6park.com 6park.comSquare Valuation: Key Assumptions 6park.comFor simplicity, the valuation extract focuses only on Square’s US opportunity. We delineate other potential growth catalysts in the last section of this piece.

Square’s seller business continues to expand, growing transaction-based revenues at a 19% annual rate through 2025.

In 2025, Cash App monetizes 20% of its estimated 75 million monthly active users (MAUs), its “primary” MAUs, at the revenue per digital user generated at JP Morgan Chase, Bank of America and Wells Fargo on average in 2019.

In 2025, Cash App monetizes another 20% of its estimated 75 million MAUs, its “secondary” MAUs, at half that rate.

Square does not monetize the remaining 60% of Cash App’s MAUs.

Square Capital, Square’s small business lending arm, increases its originations as a percentage of gross payment volume (GPV) from 2% in 2019 to 4% in 2025.

Other Square seller services grow at a 19% compound annual rate, the same rate as transaction-based revenues, through 2025.

Cash App: A Potential Consumer Bank 6park.comCash App has evolved considerably since it emerged from a Square hackathon in 2013, as shown below. Today, Cash App offers users banking services such as direct deposit, debit cards, ATM access, a platform to invest in equities and bitcoin, a rewards program, free transfers from the US to the UK, and integration with Square sellers. In the future, we anticipate that Cash App will offer a range of services comparable to that of traditional banks today, including personal loans, credit cards, mortgages and insurance. Ultimately, we believe that Cash App will offer a better and more personalized user experience at a much lower cost than traditional banks. Moreover, as a comprehensive Digital Wallet incorporating Square’s seller ecosystem, Cash App could integrate offline and online commerce, distinguishing it from both traditional and challenger banks. 6park.com 6park.comSquare Valuation Cash App Product Evolution 6park.comSource: ARK Investment Management LLC, 2020 6park.comOn average, Wells Fargo, JP Morgan Chase and Bank of America generate roughly $880 in revenue per active digital customer per year.[1] The net interest income tied to a small subset of customers accounts for the majority of this revenue.[2] 6park.comTo approach this rate of monetization, we believe Cash App has to solve three challenges: 1) launching and monetizing new products, 2) becoming the primary consumer financial services provider for users and, 3) perhaps most important, serving higher income demographics. Already, aiming to serve as their primary spending hub, Cash App has incentivized consumers to sign up for direct deposit with significant “Boost” discounts on goods and services as well as lower interest rates on loans. Square could use its seller base as an acquisition channel for new Cash App users by offering its loyalty via Cash App, enabling Square sellers to use Boost as an advertising platform, or facilitating closed-loop transactions between Cash App users and Square seller at lower cost for sellers than standard credit card processing, thus incentivizing sellers to convince more shoppers to transact via Cash App. Cash App also is leveraging innovative marketing strategies to attract new customers across all demographic groups in the US. We describe Cash App’s innovative marketing strategies in one of our previous blogs. 6park.comIn previous research, we learned that a disproportionate percentage of Google searches early in Cash App’s development were in the southern US, states with high unbanked and underbanked rates. In 2019 and 2020, however, search activity for Cash App in other states picked up significantly, pointing to user growth in higher income demographics. 6park.comIn our view, meeting the three challenges mentioned above, Cash App will increase its average revenue per user by (ARPU) 49% at a compound annual rate during the next five years, from $25 last year to $260 in 2025. From 2016 to 2019, with only two main revenue streams – Instant Deposit and Cash Card – its ARPU increased at an annual rate of 82%, from $2.2 to $25.[3] For reference, private challenger bank Chime generated $100 in revenue per direct deposit customer, per our estimates. 6park.comIn the chart below, we describe 10 Cash App monetization scenarios and, holding all other assumptions constant, provide our forecasts of their impact on Square’s stock price. We divide Cash App users into three groups: primary Cash App users who monetize at an $880 ARPU (average revenue per user), the same rate on average as bank customers; secondary Cash app users who monetize at half that rate, or $440; and unmonetized users who use only Cash App’s products that are free. We also assume that Cash App’s estimated 75 million monthly active users break down into the three groups in 2025: 20% primary, 20% secondary, and 60% unmonetized, resulting in an average ARPU of $260. The projected share price changes substantially dependent on Cash App’s monetization level. 6park.comSquare’s projected price target depends importantly on the three groups of Cash App monetization. If primary and secondary users each were to monetize at 30% instead of 20%, its price target would approach $500, delivering a 26% compound annual rate of return during the five years ended December 2025. Even if primary and secondary Cash App users were to monetize at only a 10% rate, Square could appreciate at a 10% annual rate to roughly $250 per share in 2025.[4] 6park.comSquare Valuation_Cash_App_User_Mix 6park.comForecasts are inherently limited and cannot be relied upon. 6park.comSource: ARK Investment Management LLC, 2020 6park.comWe believe that the network effects associated with Cash App’s peer-to-peer (P2P) payments network have given Square a significant competitive advantage relative to traditional banks and private bank startups. As described in our previous white paper, Cash App’s P2P payments network lowers customer acquisition costs and increases retention rates. For both social media and peer-to-peer payment applications, the utility of the networks increases as an exponential function of the total number of people on the network.[5] The network effects associated with peer-to-peer payments could prove more effective than those that Facebook, Google, and other social media enjoyed 10 to 15 years ago. Importantly, Venmo and Cash App users have a financial incentive to invite their parents and grandparents onto the platforms, an incentive that did not exist when Facebook and Instagram launched. Moreover, to avoid unpleasant interactions months after splitting the costs after a night on the town, family and friends can lure users back to Venmo, Cash App, and other P2P platforms when requesting long delayed repayments. 6park.com 6park.comSquare’s Seller Business: A Superior Value Proposition 6park.comTen years after launching a revolutionary credit card ‘dongle’ reader, in our view Square still offers sellers the best value proposition. While credit cards have commoditized during the last ten years, Square has focused on enabling businesses to grow with a suite of software services and access to working capital. 6park.comLike Cash App’s network effects on the consumer side of the equation, software services seem to have increased seller retention as measured by Square’s positive gross profit retention for cohorts measured quarterly and annually since 2012. Moreover, according to a Jefferies survey in 2019, Square Payroll is the second most popular payroll software in the US small and medium business space, trailing only Intuit’s QuickBooks. While it has lost international sellers, we believe Square has substantial runway in the US to offer a cost effective and convenient way not only to accept payments but also to help entrepreneurs manage their businesses, especially given its newly acquired Industrial Loan Company (ILC) bank charter. As a result, we believe that Square should be able to double its penetration of the US general purpose card purchase volume from 2.7% in 2019 to 5.5%, growing transaction-based revenues at a 19% annual rate during the next five years. Likewise, Square Capital originations should double from 2% of GPV to 4%. Shorter term, while COVID-19 shut down many originations, the Payroll Protection Plan introduced thousands of new sellers to Square’s lending capabilities. 6park.com 6park.comFurther Growth Opportunities 6park.comWe believe that Square will enjoy several growth opportunities beyond the scope of this blog and valuation extract. Among them are the four described below. 6park.com 6park.comThe convergence of seller and consumer ecosystems 6park.comSquare is one of the only companies in the world with real-time front-end access to both consumers and businesses. Square’s hardware and software engage businesses at the point of sale (POS) and consumers with Cash App’s P2P network. In contrast, while Visa credit cards impact millions of consumers and merchants, many third parties sit between them, preventing Visa from engaging with either consumer or businesses in real time.[6] 6park.comAt some point, in our view, Square will be able to facilitate transactions directly between its sellers and Cash App users, disintermediating most third parties and optimizing its unit economics. Today, Square pays fees, including those for interchange, assessment, processing, and bank settlement, to various third parties. When one of its sellers accepts a $50 payment, for example, Square charges $1.47, or 2.95%, but retains only $0.50, or 1% of the purchase value, as its net take-rate. If it were to cut out the middlemen and facilitate payments directly between sellers and Cash App users, Square could leave pricing unchanged and almost triple its net take-rate or lower pricing and undercut most competitors. In the latter scenario, Square sellers would have an incentive to maximize the number of Cash App transactions and minimize the number of other card transactions, effectively becoming sales agents for Cash App. Square also could incentivize them to become Cash App sales agents with access to an advertising platform and to millions of consumers with every day discounts via Boosts. 6park.comAt some point, Square could integrate Square Online Store with Cash App, enabling Cash App users to search for and purchase Square seller products, much like Shopify’s Shop application. If done so successfully, Square could charge sellers for advertising their products on Boost or for search results akin to Amazon’s Sponsored Brands. Ultimately, we believe Cash App could enable an e-commerce platform and benefit from many new revenue streams. 6park.com 6park.comInternational 6park.comIn our view, Square’s ecosystem has tremendous international growth potential, both for sellers and Cash App users. Historically, Square has focused on building proprietary technology and deep partnerships, taking time to understand markets, rather than blitz-scaling across geographies. This methodical approach seems likely to pay dividends, especially in Europe, during the next five years. In July 2020, Square began recruiting for an Italian-speaking customer support position[7] and, in September, Cash App was looking for a European Operations Manager.[8] Before launching officially in Europe, however, Cash App probably will use Verse, a P2P payment startup Square acquired earlier this year to increase its understanding of European markets. In emerging markets, Cash App could leverage bitcoin, as explained below. 6park.comThat said, Square still has large opportunities in its existing international markets: Canada, Japan, UK and Australia. In Australia, for example, large banks have left rural areas, giving Square an opportunity to partner with smaller institutions and fill in the void left behind. 6park.com 6park.comBlockchain 6park.comPerhaps unsurprising given Jack Dorsey’s public advocacy , Square enabled Cash App users to buy and sell bitcoin in 2017. In our view, Square will use Bitcoin, the decentralized network, and bitcoin, the cryptocurrency, to enter new geographies, especially Africa during the next few years. Dorsey had planned to spend time in Africa this year before COVID-19 derailed the opportunity. Cash App could use Bitcoin to overcome the fragmented and inefficient financial infrastructure in Africa and other developing geographies, however likely would still face Know Your Customer (KYC) and Anti Money Laundering (AML) requirements and other cross-border regulatory challenges. 6park.comFurthermore, Square could use the Lightning Network, a second layer application on top of Bitcoin, to disintermediate third parties in transactions between and among Cash App users and Square sellers. The Lightning Network could provide an additional revenue stream for Square. Square also could lend the bitcoin on its balance sheet, an opportunity that we will discuss in a forthcoming blog. 6park.comPerhaps most important on the cryptoasset front, Square could build long term shareholder value through its Square Crypto initiative. Bitcoin’s success could be Square’s success, suggesting that grants to Bitcoin open source developers and marketers could benefit Square in the long term. 6park.com 6park.comAdditional cross-selling 6park.comCash App could achieve even higher ARPUs than in our base case with more efficient cross-selling than in traditional banks. Using the average $880 annual ARPU generated by traditional banks as a benchmark for Cash App, we could be overestimating the cross-selling capabilities of banks and underestimating those of Cash App. The consumption of financial services today is highly fragmented, as 55% of consumers have relationships with two or more financial services providers. In other words, consumers have committed to 1.8 financial products or services on average. 6park.comIn our view, because customers have diversified their relationships among financial institutions, the $880 in bank ARPU discussed above is a fraction of the potential value creation in consumer financial services. Non-bank providers like Charles Schwab or Robinhood for investing, LendingClub for personal loans, and RocketMortgage for mortgages are proliferating, perhaps because consumers want to diversify their risks or because banks cannot convince users to agree to more than one product or service. The reason consumers cite most when deciding on a new product or service is the rate or fee, followed by simplification. 6park.comIn our view, Cash App offers users the most cost-effective and streamlined products and services in the financial services industry as it builds personal relationships that lead to efficient and effective cross-selling. As a result, Cash App’s ARPU could be multiples higher than the $260 modeled in our base case during the next five years.