| 送交者: salonyudi[★★声望品衔9★★] 于 2020-06-07 0:34 已读 2421 次 3 赞 | salonyudi的个人频道 |

一周来美元的“几乎无声的下滑” 也为刺激米国股市反弹加油

【讨论】

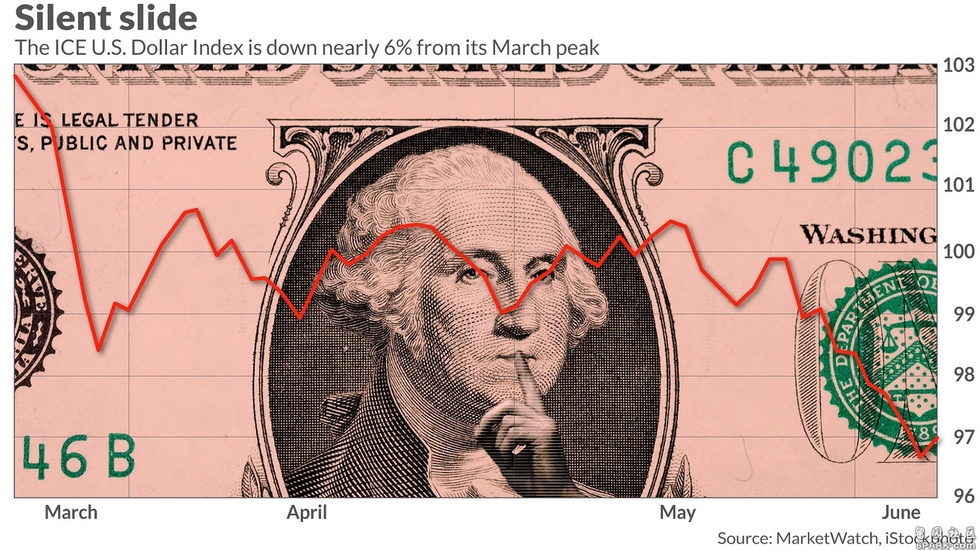

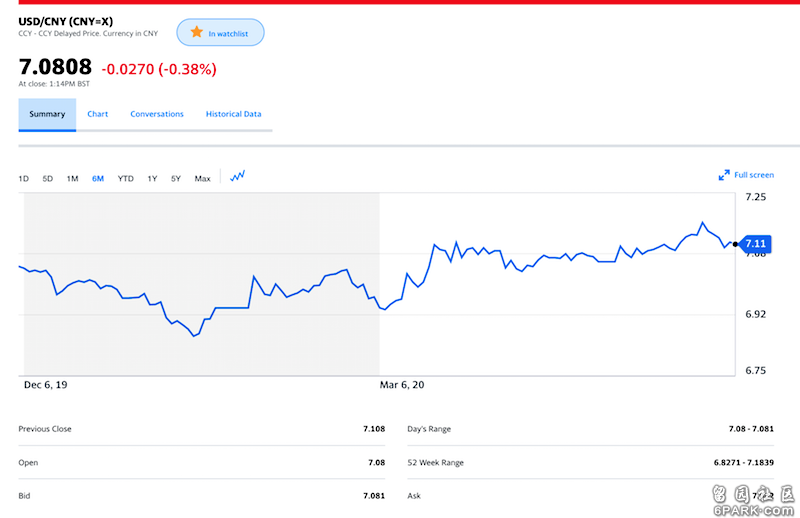

(图.0)6park.com3月中旬,由于新冠疫情引发的恐慌,引发了美元的争夺,美元指数(DXY)急升至102.82;

上周DXY指数已从峰值回落了大约-5.9%,期间经历了2个月的波动。

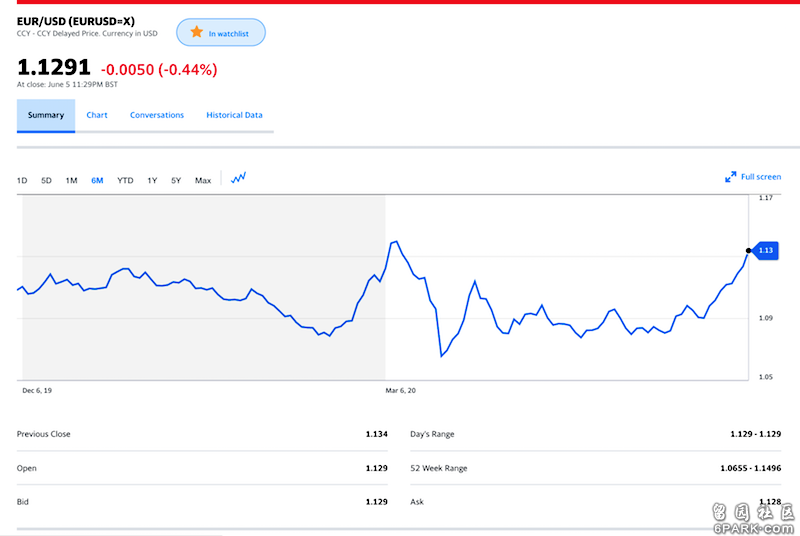

(图.1)6park.com这一轮的美元贬值,主要是欧元的升值引起的。

(图.2)

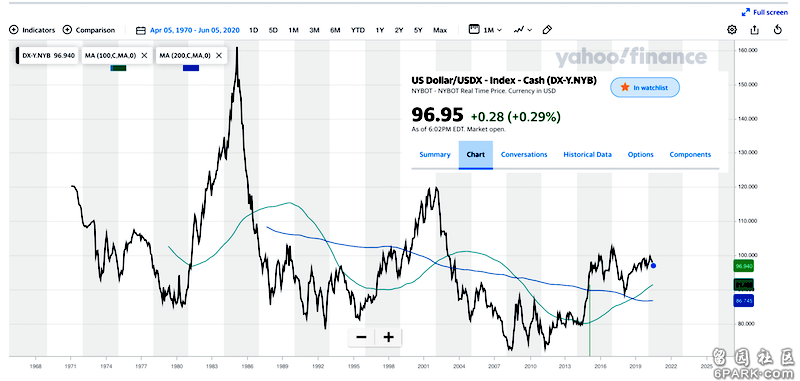

不管近期美元是否还会走强,从长远来看,美元是走下坡路的。

(图.3)6park.com美元疲软通常对米国股市来说,是可喜的消息。

同时,美元贬值对米国商家出口商品有利,对米国经济的复苏也能助把力。

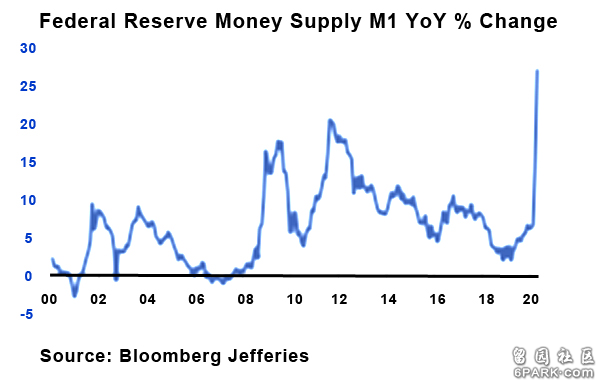

尽管随着人们对新冠疫情的担忧逐渐消退,美联储仍然继续以前所未有的速度向全球货币体系注入流动性。

(图.4)6park.com美联储印了辣么多绿纸,美元又在贬值,可能会带来通货膨胀的危险;

下一轮股市的大修正(correction)中,可以考虑把手里的cash尽量买些股票。

新兴市场近年来以美元借贷的额度上升,因而美元走软对新兴市场是一种缓解。

但是对持有大量美债的债主们,比如种花家,则是相反的效应。

(图.5)

[原文链接:https://www.marketwatch.com/story/heres-another-reason-for-the-stock-market-rally-the-us-dollars-almost-silent-slide-2020-06-05?mod=MW_article_top_stories] 6park.com[原文转载:]How the U.S. dollar’s ‘almost silent slide’ is juicing the stock-market rally

Published: June 6, 2020

By William Watts 6park.comICE U.S. Dollar Index down nearly 6% from March pandemic panic peak 6park.comInvestors might not have noticed it amid all the excitement, but a stealthy slide by the U.S. dollar should get some of the credit for the stock market’s stunning rally. 6park.comThe ICE U.S. Dollar Index DXY, +0.28%, a measure of the U.S. currency against a basket of six major rivals, rose 0.3% Friday to 96.70, but remained on track for a 1.4% weekly decline. The index had traded at a more-than-three-year high near 103 in mid-March as the panic created by the COVID-19 pandemic created a global scramble for dollars. The index has retreated around 5.9% from that peak, leaving it up around 0.6% for the year to date. 6park.com“There were plenty of distractions last month but the almost silent slide in the greenback must go down as one of the most unremarked devaluations in history,” wrote Sean Darby, chief global equity strategist at Jefferies, in a Wednesday note. 6park.comA weaker dollar is often welcome news for U.S. equities, as it makes exports of U.S. good cheaper to foreign buyers. But thanks to the dollar’s role as the international reserve currency, It can also be a boon for global growth, particularly since its run-up came as companies around the world drew down credit lines in an effort to hoard dollars, boosting funding costs. The Federal Reserve responded by expanding existing swap lines with major central banks and opening new swap lines with others, while taking additional steps to meet dollar demand. 6park.com‘There were plenty of distractions last month but the almost silent slide in the greenback must go down as one of the most unremarked devaluations in history.’

— Sean Darby, chief global equity strategist at Jefferies 6park.comA weaker dollar comes as a relief to emerging markets, where borrowing in dollars has risen in recent years. A weaker buck can also be a positive for commodities that are priced in the monetary unit, making them cheaper to users of other currencies. 6park.comDXY broke a support line near 99.00 last week, and the prospect of a 10% retreat from the highs has increased substantially as it approaches a “modest” support line at 96, said Steven Ricchiuto, U.S. chief economist at Mizuho Securities, in a Friday note. 6park.com“Such a decline in the dollar will help support energy and other commodity prices and, in the process, reduce the deflation risk confronting the domestic economy,” he said. “These strong macro trends are feeding the ongoing rally in stocks and credit.” 6park.comIn One Chart:Commodity bulls poised to cheer if ‘King Dollar’ loses its crown 6park.comAs fears of the COVID-19 pandemic recede, Darby said, “the Federal Reserve is continuing to add dollars to the global monetary system at an unprecedented rate (see chart below).”

Jefferies 6park.comMeanwhile, a rise in the 10-year break-even inflation rate — a market-based measure of inflation expectations, rose after previously lurching into deflation, he said. “One of the most important turning points for the direction of equity markets is the shift into inflation.” 6park.comStocks traded sharply higher Friday following a May jobs report that showed an unexpected rebound in nonfarm payrolls and a drop in the unemployment rate, though the jobless rate remains excruciatingly high at more than 13%. 6park.comThe Dow Jones Industrial Average DJIA, +3.15% soared more than 1,000 points at its session high, and ended the day with a gain of 829.16 points or 3.2%, while the S&P 500 SPX, +2.62% advanced 2.6%. 6park.comStocks plunged in March as the pandemic began forcing the lockdown of major economies, with the S&P 500 dropping nearly 34% through March 23 from an all-time closing high of 3,386.15 on Feb. 19. Equities have since bounced back to retake a large chunk of that decline, with the S&P 500 trading just 5.5% below its peak. The tech-heavy Nasdaq Composite COMP, +2.06%, meanwhile, did top its previous all-time high in intraday trade Friday. 6park.comThe dollar’s fall from its March peak has been broad-based, reflecting, in part, a revival in appetite for risk, analysts said. The currency has declined against all so-called G-10 currencies except for the traditional havens of the Swiss franc USDCHF, +0.13% and Japanese yen USDJPY, +0.02%, while falling more than 4% against the New Zealand dollar USDNZD, -0.04%, the Norwegian krone USDNOK, -0.11% and the Australian dollar AUDUSD, +0.01%, noted Kit Juckes, global macro strategist at Société Générale, in a note. 6park.comHe observed that the New Zealand dollar, krone and Aussie currencies were also this week’s top performers — “Trade and cycle-sensitive, and helped along by the strength of US and Chinese data and by higher oil prices. The speed of the bounce is scary, the levels themselves less so.” 6park.comMeanwhile, a 1.7% rise by the euro EURUSD, -0.04% this week is “impressive, but it’s position in the rankings tells us this is much more a dollar than a euro story,” he said.