| 送交者: salonyudi[★★声望品衔9★★] 于 2020-08-13 22:42 已读 2863 次 | salonyudi的个人频道 |

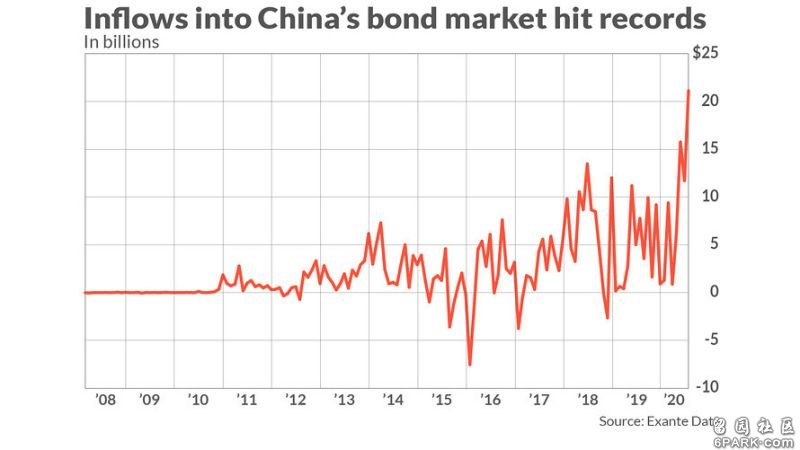

摘译自:《MarketWatch》2020年7月,流入种花家??债市的外国资金总量创下新高纪录。 6park.com长期以来,西方资本对种花家的债券不感冒,也是因为种花家的资本市场相对封闭,外国的理财经理们不方便随意随时拿?进进出出。近来,随着种花家资本市场对全球投资者的更开放,纽约和伦敦的投资者对种花家的债卷越来越感兴趣。 6park.com可以肯定的是,全球债券购买者加大了对中国债券投资的压力,部分原因是??债市相对于其他债券市场的强劲表现。摩根大通(J.P. Morgan)以美元计价的新兴市场债券指数EMB(iShares J.P. Morgan USD Emerging Markets Bond ETF)的年均回报率通常为3.7%;但是,截至7月31日,在过去的12个月中,EMB的回报为-0.11%。而富时(FTSE)的中国政府债券指数在同时期里,随着种花家债券市场准入和流动性改善,回报率为4.2%。 6park.com2020年第二季度,中国债市的外国资金流入达到了创纪录的$335亿美元;仅在7月,流入量就达到$200亿美元,是有记录以来的最高月份。 Inflows into Chinese bond market hit records in July

spurred by fears of missing out

自2019年以来,彭博社(Bloomberg)和FTSE Russell一直在逐步将中国债卷纳入基准债券指数。这反映出对北京为外国投资者开放直接进入其债券市场的努力作出的积极反应。中国债券目前占彭博全球综合债券指数(Bloomberg Global Aggregate Bond Index)的5.3%,占摩根大通新兴市场债券指数(JP Morgan’s emerging market bond index)的9.4%。 6park.com(原文中有更多的参考数据,请阅读全文,ZT如下:)

————————————————————————————————————————————————————Inflows into Chinese bond market hit records in July, spurred by fears of missing out

《MarketWatch》

Published: Aug. 12, 2020

By Sunny Oh

Global benchmark indexes embrace Chinese bonds, attracting inflows into debt of the world’s second largest economy 6park.comGlobal investors are overcoming their long aversion to China’s bond market as they take up a larger share of global benchmark bond indexes. 6park.comDebt from the world’s second largest economy historically has been overlooked by foreign investors as it’s closed capital markets prevented outside money managers from taking funds in and out of the country at will. 6park.comBut Chinese bonds have been forcing their way slowly into the holdings of overseas funds based in New York or in London, thanks in large part to recent initiatives by Beijing to open up its financial markets to the outside world and its resulting inclusion into passive investing indexes - which carry significant sway over how, and where, portfolio managers allocate their cash. 6park.com“In years gone by, China might have been an interesting story, and it might have been something you were curious about. But it didn’t need to be assessed that seriously,” said Jonathan Orr, a portfolio manager at Goldman Sachs Asset Management, in a webinar on Tuesday. 6park.comBut this view has waned among overseas investors who increasingly realize that the decision to avoid China’s bond market could leave them at risk of under-performing their competing indexes and their peers. Put another way, index-based investors “now have to take a view on China,” said Orr. 6park.comTo be sure, the pressure to invest in Chinese debt has intensified among global bond buyers, in part, because of its strong performance relative to other debt markets. 6park.comThe FTSE China government bond index has returned an annual 4.2% in the last 12 months as of July 31, compared with a 3.7% return for the J.P. Morgan’s flagship dollar-denominated emerging market bond index EMB, -0.11% over the same stretch. 6park.comForeign inflows to Chinese bonds reached an all-time high in the second quarter of $33.5 billion. And in July, inflows reached $20 billion alone, its highest month on record, according to Exante Data, which tracks the movement of capital across the world. 6park.comSince 2019, Bloomberg and FTSE Russell have been slowly phasing in China’s inclusion into benchmark bond indexes. This reflects the favorable response to Beijing’s efforts to open up direct access to its bond markets for foreign investors. 6park.comFor example, the Hong Kong-based Bond Connect, started in 2017, allowed investors who weren’t domiciled in mainland China to buy as many of the country’s bonds they wanted, without having to deal with the lengthy hassle of registering an account in the country and applying for a quota. 6park.com“Similar to what occurred with the equity indices, the bond index providers have recognized these reforms and moved to include China as a result,” said Nicholas Borst, director of China research at Seafarer Funds, in e-mailed comments. 6park.comChinese bonds now represent 5.3% of the Bloomberg Global Aggregate Bond Index and 9.4% for JP Morgan’s emerging market bond index. 6park.comBeyond passive inflows, China’s bond market also has become attractive in its own right. 6park.comIn a yield-starved world, the country’s government bonds offer the richest income in comparison to other developed debt markets, said Alex Etra, a senior strategist at Exante Data. 6park.comEven as the Federal Reserve cut interest rates to rock-bottom this year, the People’s Bank of China only trimmed its benchmark loan prime rate to 3.85% from 4.15% at the start of 2020. 6park.comAnd the widely-watched 7-day rate to borrow funds in the bond repurchase market, a barometer of China’s monetary policy stance, has risen to above 2% after hovering around 1.5% in May. 6park.comThe 10-year Chinese government bond yield AMBMKRM-10Y, 2.995% traded at 3.00%, compared with the 0.68% on the 10-year Treasury yield. TMUBMUSD10Y, 0.671% Bond prices move inversely to yields. 6park.comMoreover, investors note that China’s government bonds march to the beat of their own drum, and have not followed the direction of government bonds from the U.S. and Europe, even though they shared similar safe haven characteristics with those markets, said Rob Waldner, head of macro research for Invesco fixed income. 6park.comThose qualities have drawn investors who prize diversification into Chinese debt as stocks and bonds across global sectors and countries move increasingly in sync, offering fewer places to shelter from a sudden market selloff. 6park.comEven with record inflows this year, there could be scope for additional funds to pour into China’s bond market as money managers still often remain underweight, according to Exante Data. 6park.comOrr cited estimates that another $250 billion of inflows could arrive into China’s bond market due to their recent inclusion into the three major indexes provided by JP Morgan, FTSE Russell and Bloomberg. 6park.comReference:

https://www.marketwatch.com/story/inflows-into-chinese-bond-market-hit-records-in-july-spurred-by-fears-of-missing-out-2020-08-12