| 送交者: xiaobeng[★★声望品衔10★★] 于 2022-07-29 3:49 已读 1920 次 | xiaobeng的个人频道 |

Iron ore lifts on Chinese stimulus, aluminium supplies tumble 6park.comIron ore: China's stimmy

Iron ore is set to rally almost 10% this week, with futures on the Singapore Exchange trading close to a 1-month high of US$115 a tonne.

There were quite a few stimulus-related headlines being thrown around this week, bolstering optimism for iron ore demand.

The People's Bank of China will issue approximately 200bn yuan (US$30bn) worth of low interest loans to state banks, according to the Financial Times. Policymakers hope the banks will leverage this up to five times to provide up to 1tn yuan (US$150bn) worth of loans for stalled projects.

Earlier this week, the Chinese government announced plans to set up a separate real estate fund worth up to 300bn yuan (US$45bn), where proceeds can be used to buy financial products issued by embattled property developers.

Singapore iron ore futures (Source: TradingView)

Aluminium: Muted gains, freefalling supplies

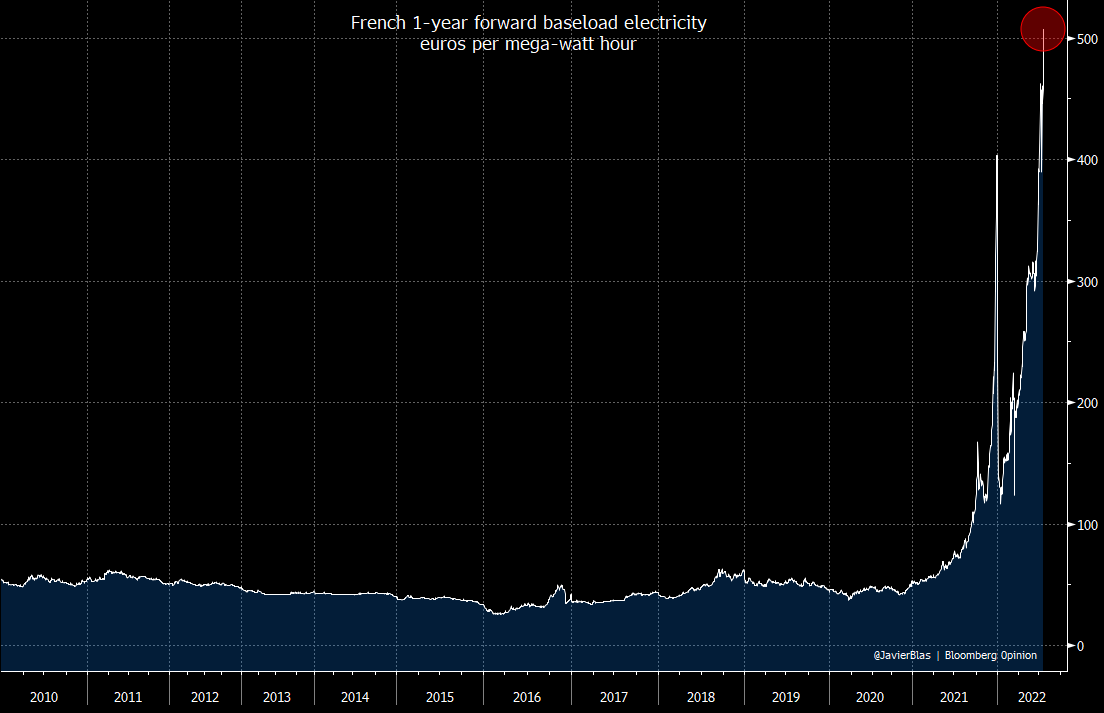

Last week's spotlight talked about how Europe has lost about half its aluminium smelting capacity in the last 12 months and runs the risk of production going even lower amid high electricity prices and the lack of energy resources.

Well, European energy prices continue to go berserk and now, aluminium stockpiles at the London Metal Exchange tumbled to 31 year lows of 295,325 tonnes, equal to just 1.5 days of consumption.

Source: Bloomberg

Still, aluminium prices remain rather muted, trading flat for the week.

Though, with rising production warnings from large European names like Norsk Hydro, it might be worth keeping an eye out for inventories and spot prices moving forward.

Aluminium spot price (Source: TradingView)

Gold: Starting to move

Gold started to show signs of stabilising around US$1,700 last week and now, starting to rally on expectations of slower tightening, a weaker US dollar and rising recession risks.

The Fed's view that it will likely become "appropriate to slow the pace of increases" means that the non-yield bearing yellow metal can finally start behaving like a safe haven asset again.

"Gold’s biggest risk was that the economy was remaining robust and that the Fed might need to be more aggressive with rate hikes," said Oanda senor market analyst, Ed Moya.

Though, after a second consecutive negative GDP reading, the "risk of a full-percentage rate hike by the Fed is long gone."

贴主:xiaobeng于2022_07_29 3:50:40编辑