| 送交者: xiaobeng[★★声望品衔10★★] 于 2022-08-15 23:51 已读 1207 次 1 赞 | xiaobeng的个人频道 |

The ASX 200 has recovered around half the -16% losses it suffered between April and JuneThe market is approaching an inflexion point between recessionary and non-recessionary performanceHeadline inflation is starting to peak in the US, but core inflation remains sticky 6park.comThe S&P/ASX 200 has recouped roughly half the losses it suffered from the sharp -16% selloff between April and June.

In a rather V-shaped recovery, an optimist would say there’s been a stepchange in the market as valuations were somewhat reset, inflation is beginning to top and central banks begin to pivot from peak hawkishness.

On the flip side, the pessimist might say the rebound has been too sharp and warrants a correction, inflation remains sticky and far from the 2-3% target ban and interest rates are still on the rise until otherwise.

Whether you're bullish or bearish, here's some food for thought for the market's outlook.

1. Recession or not

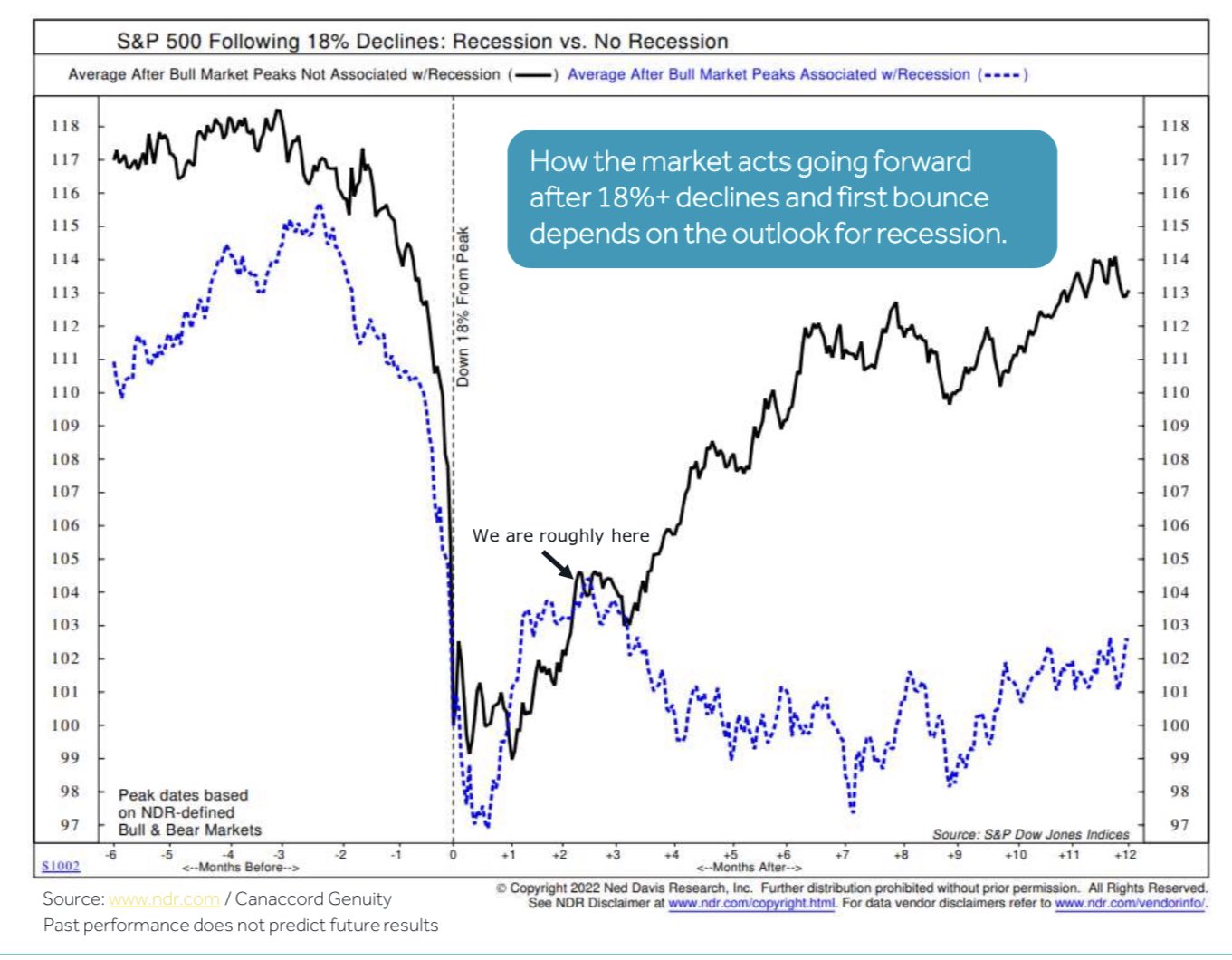

This was briefly mentioned in Thursday's Morning Wrap. The chart by Cannacord Genuity depicts S&P 500 performance after an -18% drawdown under recessionary and non-recessionary conditions. In short:

If a recession is avoided, then recent lows would represent the bottom of the bear market. Happy days from here

If we're in a recession, then the bounce was just a 'bear market rally' and market will revisit previous lows

Source: Cannacord Genuity

2. Headline peaks but so what

US inflation decelerated in July to an annual rate of 8.5% compared to 9.1% in June thanks to notable declines in gas prices, airfares and used car prices.

Not all was good as shelter and food prices increased, which was reflected in a steady core inflation reading of 5.9%.

“Energy and food, in particular, are going to be much weaker drivers of inflation, so the headline number is going to come down,” Mohamed El-Erian, Chief Economic Adviser at Allianz told Yahoo Finance.

“But worse, the core number is going to stay stubbornly high. That speaks to an inflation process that has become more entrenched and become more broad-based in our economy," he added.

More specifically, shelter is the single biggest component of CPI, worth around 33% of the index and widely understated, up 5.7% year-on-year.

The Fed uses core CPI as its primary inflation gauge, which means easing shelter prices is likely what's needed to inspire a meaningful pivot.

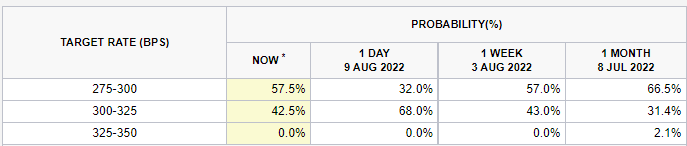

Still, easing headline inflation has seen target interest rate probabilities tip in favour of a 50 bps rate hike in September.

Source: CME Group

3. Thinking technicals

The ASX 200 is facing some resistance as it tries to push above the 200-day moving average (blue). Though, the fatigue might come as no surprise following the almost 10% rally since late June.

In the event of a pullback, can the market retreat in an orderly manner and consolidate around the recent 6,900 level.