| 送交者: salonyudi[★★声望品衔9★★] 于 2020-07-06 18:10 已读 2216 次 | salonyudi的个人频道 |

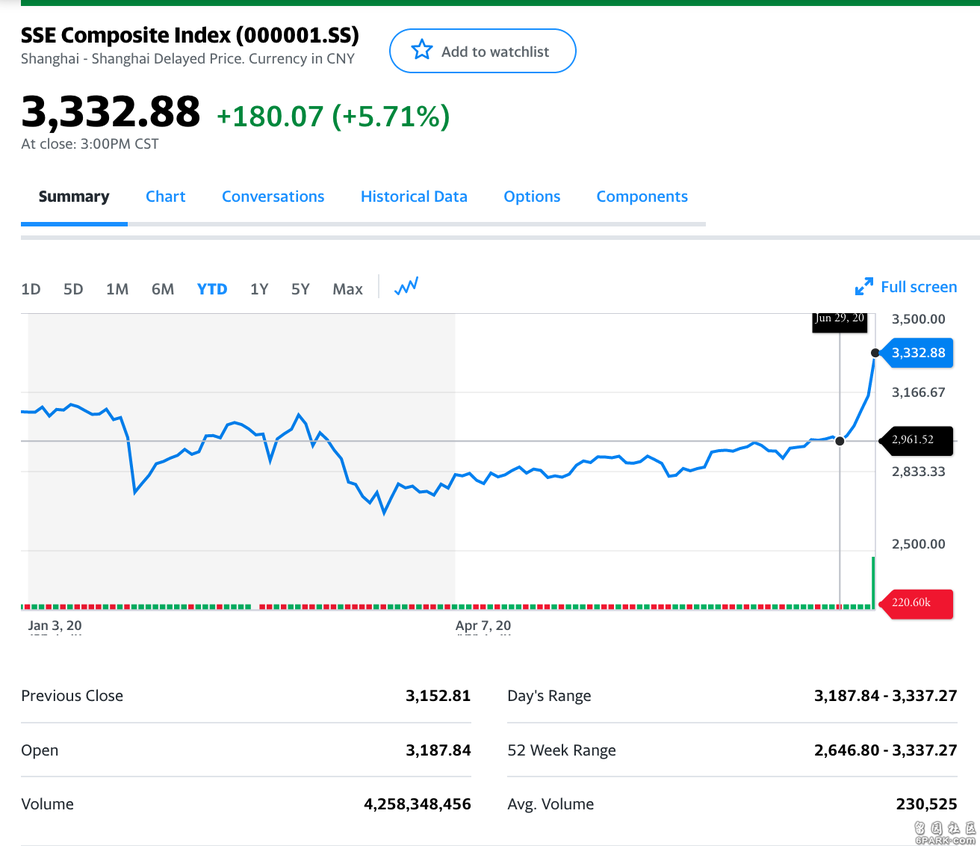

A股市近来涨幅惊人:

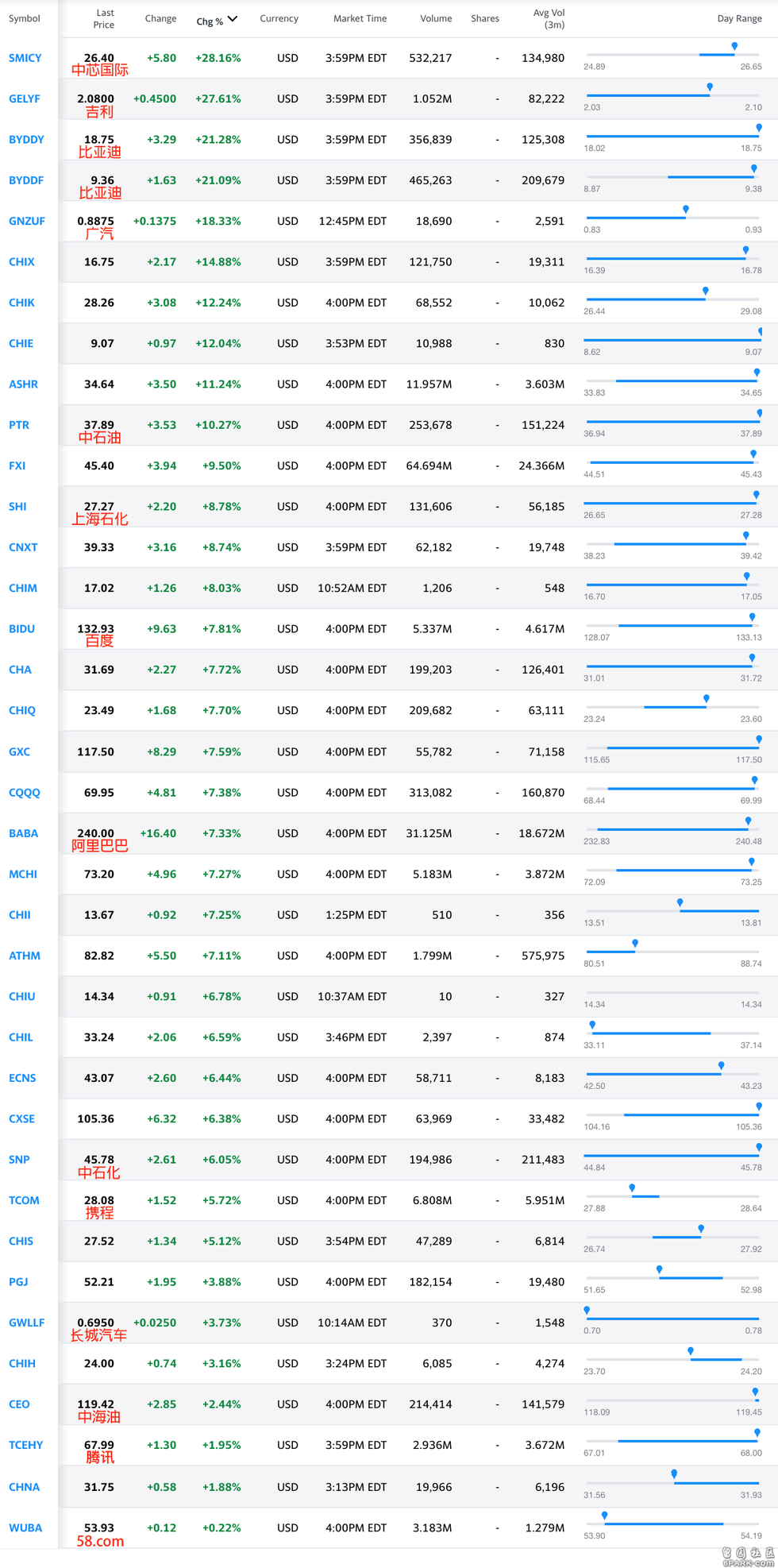

值得注意的是,今天在米国股市上市的种花家??的公司的股价也随之飙升:彭博提醒炒股的小心2015年A股市崩盘的悲剧重演

彭博今天(2020.7.6)发表一篇评论说:种花家A股市又在重复2015年的泡沫,沪深300指数现在已经在5天之内上涨了14%,是2014年12月以来的最高涨幅,上涨的力度与2014年最后几周,市场崩盘开始之前的场景相近。 6park.com种花家官方媒体正在鼓动建立“健康的”牛市,但是,追赶A股市的不仅仅是本地的投机商,全球最大资产管理公司黑岩(BlackRock Inc.)表示,预测在今后的6到12个月里,中国的股票和债券的表现将优于全球新兴市场。 6park.com证劵商的股价飙升,日均成交量自2015年以来首次突破1.5万亿元人民币(合$2,130亿美元)。低利率和理财产品的亏损,也使得散户投资者的股市参与度有所增加。周一股市涨幅超过5%,这在2015泡沫破灭以来,还是首次。 6park.com但是这次有所不同的是,股票价格较低,股市的杠杆率大约是五年前的峰值的一半;央行也比较谨慎,星期一从金融系统中撤出了一部分资金。恒升资产管理公司的经理戴明说,不可能重复2014-15年那样的大起大落(boom-and-bust)。 6park.com证券商通常被视为市场情绪的晴雨表,周一领涨,在香港上市的证券公司的涨幅是近四年来最大的。中国国际金融有限公司(China International Capital Corp.)上调了该行业的目标价格,并预测该国股市在未来5-10年内的价值将翻番。 6park.com另一个A股市火爆的标志是,中芯国际(Semiconductor Manufacturing International Corp.)将举行十年来最大的内地股票销售。这家芯片制造商正寻求筹集多达75亿美元的资金,是分析师预测的两倍。中芯国际(SMIC)的香港股市周一跳升21%,创下历史新高,和2009年以来最大涨幅。 6park.comBloomberg 的文章转载如下:China Stokes a Stock-Market Mania, Risking Repeat of 2015 Bubble

【Bloomberg News】

July 6, 2020 6park.com(Bloomberg) -- The dramatic moves in Chinese stocks over the past week are inviting comparisons with a bubble that burst spectacularly five years ago. 6park.comIn many ways, the pace of gains matches the market’s melt-up that started in the final weeks of 2014. The CSI 300 Index has now added 14% in five days, the most since December that year. A gauge of momentum on the CSI 300 is also the strongest since late 2014. Shares of brokerages surged as daily turnover exceeded 1.5 trillion yuan ($213 billion) for the first time since 2015, indicating increasing participation from retail investors. Monday’s more-than-5% gain in stocks had only happened once before since the bubble burst. 6park.comLow interest rates and the first losses ever for some popular wealth-management products are driving China’s savers to stocks. The advance is also being aided by an enthusiastic chorus from the nation’s influential state media. A front-page editorial in the China Securities Journal on Monday said that fostering a “healthy” bull market after the pandemic is now more important to the economy than ever. Chinese social media exploded with searches for the term “open a stock account,” with bullish sentiment also boosting the yuan. 6park.comBut there are also key differences between now and 2014 -- including a lower starting point for equity valuations. And while more traders are taking on debt to buy shares, leverage in the stock market is about half what it was at its peak five years ago. The central bank has this time taken a cautious approach to liquidity, withdrawing funds from the financial system for a seventh day on Monday. 6park.com“It’s very unlikely for us to go through the boom-and-bust like we experienced in 2014 and 2015,” said Dai Ming, Shanghai-based fund manager at Hengsheng Asset Management Co., who is buying property shares. “The market isn’t flooded with money everywhere like last time. Beijing is still very prudent with its monetary policy.” 6park.comTalking up stocks is a dangerous game in China, where investment choice is limited due to capital controls. In 2014, encouraging words by state media helped revive interest in what had been a dull equity market. The result was a debt-fueled speculative bubble that burst, wiping out $5 trillion of value. Just like then, regulators have recently unveiled measures to liven up trading, including a new, streamlined approach to initial public offerings. 6park.com“The state is very cautious about creating another boom-bust as seen in 2015, realizing the harm to confidence that comes from the bust is greater than the good from the ride up,” said Wang Zhuo, fund manager at Shanghai Zhuozhu Investment Management Co. 6park.comThe CSI 300 is up 14% this year, one of the biggest gains among major global benchmarks, to trade at a five-year high. Its 14-day relative strength index has climbed to 88, the highest since December 2014. The Shanghai Composite Index rose 5.7% Monday, its biggest single-day gain in five years. Futures on the city’s SSE 50 Index of large caps jumped 9.1%. 6park.comBrokerages, typically seen as a barometer for market sentiment, led gains Monday with a Bloomberg gauge for Hong Kong-listed securities firms surging the most in nearly four years. A dozen mainland-listed brokers surged by the 10% daily limit. China International Capital Corp. hiked target prices for the industry, predicting the country’s stock market will double in value in the next 5-10 years. 6park.comSurging risk appetite is one factor behind the relentless rout in China’s sovereign bonds, with the yield on the 10-year note rising the most since 2016 Monday. The selloff is also spilling over to the credit market, where companies are shelving plans to sell debt as borrowing costs surge. They canceled about $11 billion worth of deals in June alone. 6park.comIn another illustration of bullish sentiment, Semiconductor Manufacturing International Corp. is set to hold the mainland’s largest stock sale in a decade. The chipmaker is seeking to raise as much as $7.5 billion, or more than double the cash predicted by analysts. SMIC’s Hong Kong stock jumped 21% to a record Monday, its biggest gain since 2009. 6park.comWhile the rally looks hot, investors such as He Qi, a fund manager with Huatai Pinebridge Fund Management Co, say they have made the most of lower valuations and a catch-up rally in cheaper stocks. 6park.com“I’ve been fully invested in stocks since early June to bet on the shift in market focus,” he said, adding that he had focused on brokerages, property developers and automakers. “After a tough two months or so, it’s finally my moment to shine.” 6park.com(An earlier version corrected name of publication in third paragraph) 6park.comFor more articles like this, please visit us at bloomberg.com 6park.comSubscribe now to stay ahead with the most trusted business news source. 6park.com?2020 Bloomberg L.P.